ASEAN has set its ambitious target to be carbon neutral by 2050. According to the ASEAN Secretariat, the region stands to benefit from a GDP value-add of around US$3-5 million by 2050, with Cambodia, Lao PDR, Myanmar and Viet Nam seen to have the greatest uplift of 9-12% of GDP, and middle-income countries such as Indonesia, Malaysia, Philippines and Thailand can reach 4-7% GDP increase. The ASEAN Strategy for Carbon Neutrality sets out 8 strategies to accomplish this goal focusing on the establishment of regional frameworks to integrate green value chains, harmonize standards on GHG reporting and carbon credits, connect and align green infrastructure with market requirements, development of interoperable carbon markets, deploying green capital, facilitating mobility of green talent, and sharing of green best practices.

What is the future of carbon trading in Japan and ASEAN? What does a potential future of cross-border trading look like? What role can governments play to facilitate this transition, and what can be learned from the cases of Indonesia, Japan, and Singapore?

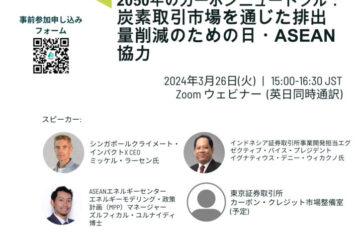

Such questions were explored during the ASEAN-Japan Centre’s second installment of the ASEAN-Japan Insights Series, entitled, “Carbon Neutral by 2050: How Japan and ASEAN Can Collaborate on Emissions Reduction through Carbon Trading Markets” held last 26 March 2024. A collaboration with the Center for Southeast Asian Studies (CSEAS), Kyoto University, the webinar brought together several key players from the carbon trading ecosystem of the region.

These stakeholders provided the audience a holistic understanding of the dynamic field of carbon offsets and emissions trading from the perspectives of government, academia, stock market, energy sector, and regional policymaker.

- Mr. Mikkel Larsen, Chief Executive Officer, Climate Impact X (CIX) Singapore presented “The Carbon Markets Potential”

- Mr. Edwin Hartanto, Head of Carbon Trading Development Unit, Indonesia Stock Exchange, IDX Carbon Exchange Indonesia presented “Accelerating Net Zero and Unlocking Indonesia Carbon Market Potential through IDXCarbon”

- Dr. Zulfikar Yurnaidi, Manager of Energy Modelling and Policy Planning (MPP), ASEAN Centre for Energy presented “Potential of Carbon Pricing in ASEAN for Decarbonization of Energy Sector”

- Mr. Matsuo Takumi, General Manager of Carbon Credit Market Development Office, Tokyo Stock Exchange presented “The Carbon Trading Marketplace in Japan”

Prof. Julie de los Reyes of the Center for Southeast Asian Studies at Kyoto University, facilitated the dialogue, as panellists dove into the current status of carbon trading in Singapore, Indonesia, and Japan and the potential for cross-border carbon trading in ASEAN and Japan – emphasizing the significance of collaboration, policy development, and market integration to maximize carbon trading’s viability as a means of addressing climate change.

As emphasized by Larsen, Asia is poised to become a global supply center for carbon credits, as the region produces nearly half of global carbon emissions, and potential value of carbon offsets is estimated at 10 billion USD annually by 2030. Despite this, carbon markets in ASEAN are still at early stages of development. In ASEAN, only Indonesia has so far established an operational compliance emissions trading system (ETS) which started in 2023. Almost all ASEAN mMember Sstates (AMS) except Brunei are involved in carbon credit activities, predominantly in voluntary carbon markets (VCMs).

Figure 1. Status and progress of carbon pricing in ASEAN

Source: Zulfikar Yurnaidi’s presentation

In Indonesia, carbon credits are traded as securities not commodities, and the primary market for ETS is regulated by the Ministry of Environment and Forestry, but accredited operators, such as IDX Carbon Exchange can trade in secondary trading markets by obtaining license from the Indonesia Financial Services Authority (OJK). Since September 2023, 494tCO2 have been traded with an estimated value of 3.9 trillion IDR.

Meanwhile, Japan established its trial carbon trading market in October 2023 through the GX-ETS and J-Credit (VCM). The carbon market is operated by the Tokyo Stock Exchange and currently has 265 registered participants, with the following large companies namely Sumitomo Corporation, Daiwa Securities, Marubeni, Mizuho Bank, MITSUI & CO., LTD. registered as market makers. From October 2023 to March 19, 2024, 208,502tCO2 have been traded.

Can Japan and ASEAN collaborate on emissions reduction through carbon trading markets?

- Establishing carbon pricing and developing local carbon markets

ASEAN Member Sstates are at varying levels of implementing their national carbon strategies. Yurnaidi states that given this, AMS with specific needs can be grouped together and receive country-specific capacity building programs for example, on carbon pricing, carbon trading, and so on. Among the initiatives of the ASEAN Centre for Energy is to build capacity on carbon pricing. Among the identified challenges in AMS include the nascent carbon trading market mechanisms, complexity of the international nature of carbon trading, and lack of monitoring, reporting and verification (MRV) mechanism, which can cause players to shy away from implementation.

Hartanto emphasizes that the MRV is an important step to ensure the integrity of carbon offset, as well as the capability to provide high quality but affordable validation and verification body (VVB). For instance, IDX ensures that integrity of exchanges to minimize the risk of double-counting or double claim for the carbon offset traded through their trading platform.

- Synergizing voluntary (VCM) and compliance (ETS) markets

An audience member posed the question, “Is it possible to have a truly regulated, proven carbon trading of an accurate and reasonable value?”

Larsen stated that to achieve their nationally determined contributions (NDCs), economies must implement and synergize both the compliance and voluntary carbon markets, like what Singapore is currently doing. Singapore established its VCM through Climate Impact X (CIX) in 2021. Singapore is the only AMS that has established carbon tax in 2019, and the Carbon Pricing (Amendment) Bill was passed in 2022 showing an increasing convergence of compliance and voluntary carbon markets.

- Connectivity between economies and local markets

Each country needs to implement a carbon pricing policy, which will allow the stakeholders to navigate the complexities of their domestic and overseas trading, and strengthen institutional capacity. This can be achieved through engaging stakeholders, such as through attracting investment in the local capital market by complementing investor initiatives in decarbonization, Net Zero, and ESG, i.e. the Principles for Responsible Investment (PRI) or Climate Action 100+’s disclosure framework.

Building upon this, connecting two national markets in a pilot trading can serve as a trailblazer. Establishing connectivity between national carbon markets requires strengthening of domestic carbon markets, and harmonizing their policies, regulations, standards and carbon pricing. However, Matsuo also cautions that emissions trading systems and carbon regulations in practice have limitations and are imperfect; there must be several systems existing in parallel which can cater to the different capacities of sectors.

Governments play critical roles in developing carbon markets by establishing it through well-placed policies, setting up a regulatory framework, providing incentives and identifying institutions to support the market. It will benefit to open collaborations with international partners for best practice and benchmarking, but it also needs to be able to localize solutions and country-specific approaches.

- Developing cross-border standardized contracts and trading mechanisms and strengthening policy and regulatory frameworks

Transparency, integrity, and regulatory frameworks were identified as crucial factors in establishing a carbon credit market. This begins with setting clear Net Zero and Carbon Neutral targets, of which ASEAN countries save for the Philippines have done over the years, notes Yurnaidi.

Matsuo notes that in order to do cross-border carbon trading, a common system between Japan and ASEAN must be put in place. Currently, the Tokyo Stock Exchange only deals with domestic carbon trading through the J-credits. Transforming these carbon credits to be CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation)-eligible so that they can be used as offsets by overseas parties will take time. In terms of carbon trading links with ASEAN countries, the Joint Crediting Mechanism in which ASEAN countries and Japan’s partner countries may participate in reduction or sequestration projects may allow for commonizing the credits. There is a possibility that overseas voluntary credits can be recognized in the GX-ETS, depending on future policy trends and cooperation between Japan and ASEAN countries.

While the AMS are at varying stages of carbon pricing infrastructures, carbon trading is widely recognized as a key instrument that could help countries and regions achieve their climate ambitions. Close cooperation and benchmarking with other markets creates synergy in ASEAN’s exploratory processes towards carbon management and climate change mitigation.

Recording of the Webinar

You can access the full recording of the webinar on YouTube.

The ASEAN-Japan Insights Series

The Series aims to be a relevant and leading information sharing platform in the region on ASEAN-Japan matters. It is a hybrid, bilingual (English and Japanese) webinar series that features hot topics in ASEAN and Japan and facilitate information sharing and knowledge sharing among industry, academia, governments, and enterprises within the region. Each webinar will be co-organized with a partner institution in ASEAN to foster cross-collaboration and co-creation between ASEAN and Japan stakeholders. For more information, please email the Research and Policy Advocacy Cluster at info_rpa@ajc-wp-preview.yucca-works.jp.